Comprehensive consultancy across the entire spectrum of India’s Foreign Trade Policy

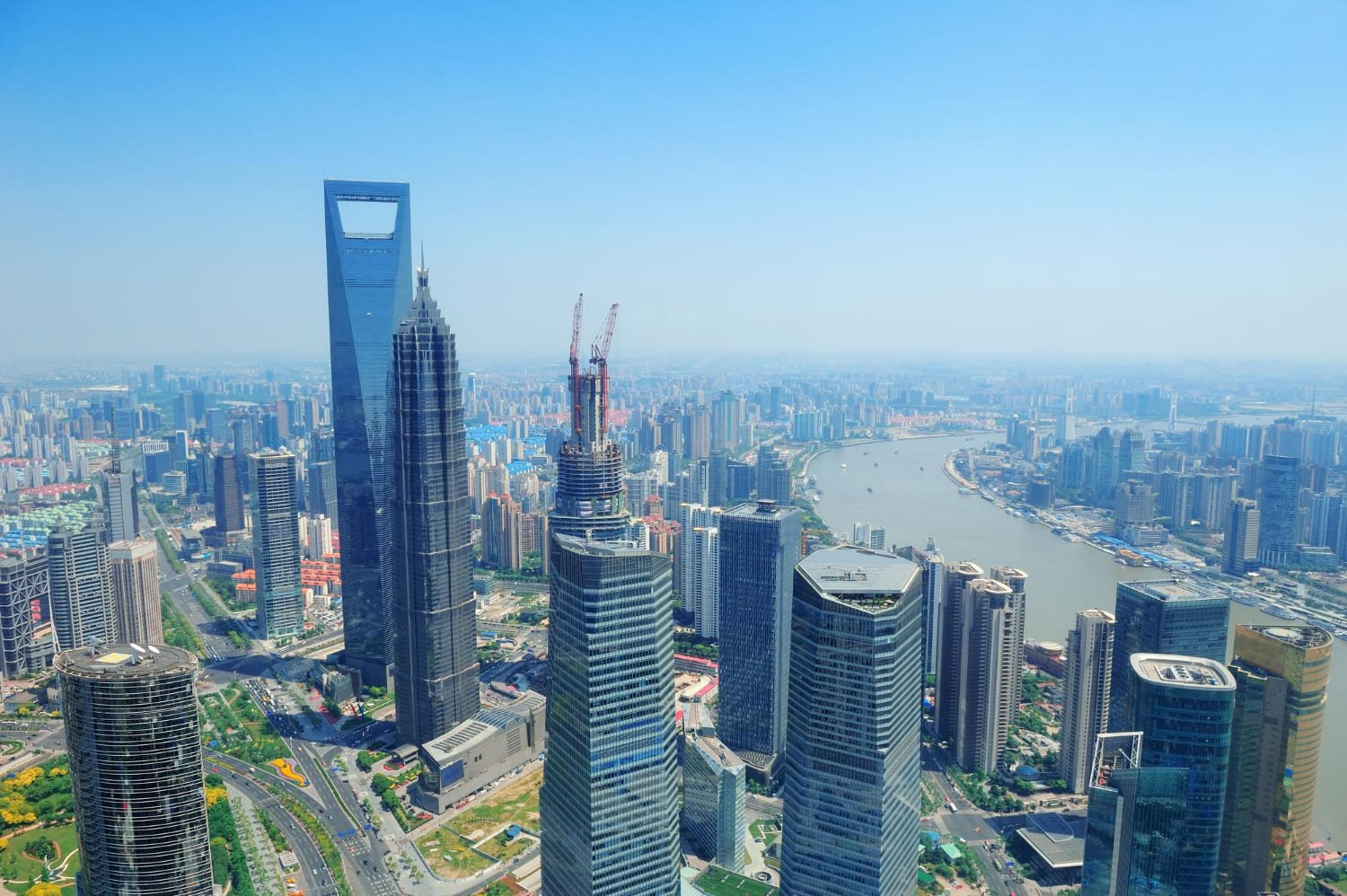

The UAE has firmly established itself as one of the world’s most sought-after business destinations. Bridging Europe, Asia, and Africa, it offers a strategic location, world-class

infrastructure, and an investor-friendly environment that attracts entrepreneurs and multinational corporations alike.

Dubai, in particular, is a magnet for startups, international conglomerates, and SMEs. Favored for

its robust legal frameworks, attractive tax structures, and targeted economic zones, Dubai

provides a fertile ground for growth. Whether through Mainland operations or specialized Free Zones, the region offers diverse opportunities tailored to foster foreign investment and business success.

Strategic Location

World-Class Infrastructure

Pro-Business Environment

The UAE offers three primary jurisdictions for company formation. Understanding the difference between Mainland, Free Zone, and Offshore is the first step to a successful launch.

Overview: Also known as an "onshore" entity. Licensed by the Department of Economic Development (DED).

Key Benefit: Allows you to trade directly with consumers within the UAE local market and government entities without restrictions.

Overview: Designated economic areas with special tax and customs regimes.

Overview: A legal business entity established with the intention of operating outside its registered Development (DED). jurisdiction.

Zero personal income tax and competitive corporate tax structures.

Zero personal income tax and competitive corporate tax structures.

Streamlined legislation and government support for rapid formation.

The gateway connecting markets in the Middle East, Africa, and Asia.

Select activity, legal structure, and allocate shares.

Register trade name and shareholder info.

Submit passport copies and photos.

Apply to relevant Free Zone or DED.

Required for processing visas.

Entry permit for owners and managers.

Travel to Dubai for medical tests and Emirates ID.

Secure residency after medical clearance.

Open corporate and personal accounts.

Sponsor your family members.

35+ Years of Legacy

Proven Expertise

Trusted Leadership

Responsive, Reliable Support

We understand the intricacies of UAE regulations, banking

compliance, and global trade policy. We are dedicated to helping you navigate these landscapes with confidence and ease.

Setting up a business in Dubai can be a complex process, but with

MNM Global, we simplify it. Whether you’re choosing between a mainland or free zone setup, we provide tailored advice to help you make the right decision.

From initial consultation to handling paperwork and approvals, we take care of everything so you can focus on building and growing your

company.